The accounts receivable turnover ratio is an important indicator of a company's financial health and efficiency. Importance of calculating accounts receivable turnover ratio Additionally, a low ratio may indicate that the company needs to review its credit policies and collection procedures to improve its cash flow and overall financial health. It is important to note that the accounts receivable turnover ratio should be compared to industry benchmarks and historical data to determine whether the company's performance is improving or declining.

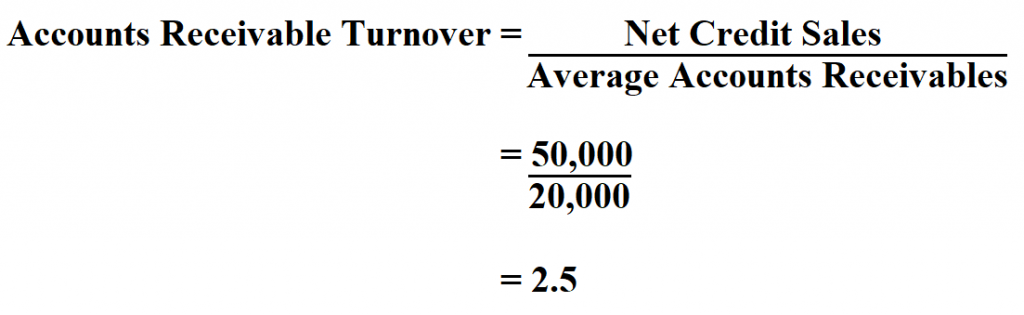

A high ratio indicates that the company is collecting payments quickly, while a low ratio suggests that the company is struggling to collect payments in a timely manner. The accounts receivable turnover ratio is an important financial metric that measures how efficiently a company is collecting payments from its customers. The formula can be expressed as follows:Īccounts Receivable Turnover Ratio = Net Credit Sales / Average Accounts Receivable The average accounts receivable is calculated by adding the beginning and ending accounts receivable figures and dividing the sum by two. Net credit sales refer to the total sales made by the business on credit terms, less any returns or discounts allowed. To calculate the accounts receivable turnover ratio, you need two pieces of information the net credit sales and the average accounts receivable for the period in question. Understanding the formula for calculating accounts receivable turnover ratio As such, it's important to compare a business's ratio to others in the same industry to get a more accurate picture of their financial health.

For example, a business that primarily sells to other businesses may have a longer payment cycle than one that sells directly to consumers.

It's also worth noting that the accounts receivable turnover ratio can vary widely depending on the industry and the specific business. On the other hand, a low ratio may suggest that a business is struggling to collect payments, which could lead to cash flow problems and potentially even bankruptcy. One important thing to note is that a high accounts receivable turnover ratio is generally seen as a positive sign for a business, as it indicates that they are able to collect payments from customers quickly and efficiently. The ratio is calculated by dividing the net credit sales by the average accounts receivable over a given period of time. It helps businesses understand their cash flow situation and identify any potential issues with late or unpaid invoices. The accounts receivable turnover ratio is a financial metric that measures how efficiently a business is able to collect payments from its customers. What is accounts receivable turnover ratio? Real-life examples of how businesses have benefited from improving their accounts receivable turnover ratio.Implementing strategies to manage account receivables and increase the accounts receivable turnover ratio.Analyzing accounts receivable turnover ratio for investment decisions.Accounts receivable turnover ratio in relation to industry benchmarks.Accounts receivable turnover ratio vs collection period: what's the difference?.Common mistakes in calculating accounts receivable turnover ratio.

GAP INC ACCOUNT RECEIVABLE TURNOVER RATIO HOW TO

How to improve accounts receivable turnover ratio.Interpreting accounts receivable turnover ratio.Factors affecting accounts receivable turnover ratio.Importance of calculating accounts receivable turnover ratio.Understanding the formula for calculating accounts receivable turnover ratio.What is accounts receivable turnover ratio?.Give us a call to learn how we can help you succeed: +1-84 (Canada) / +1-84 (US). This would include credit guarantees or accounts receivables management services from a company such as Accord, that has over 40 years of experience steering companies away from bad debt losses. However, you can also implement strategies to prevent bad debts before they occur. Often a collection agency will be able to help you recover a portion of your bad debts. evidence of the collection process’ conformance to state/province regulations-you may be liable for your agency’s behavior if no prior due diligence has been done.a dedicated trust account to gather payments from your debtors separately from those of other.a volume of debt being collected of a similar scale as that which you need collected.a history of successfully collecting on defaulted debts.The best bad debt collection agencies have the following main characteristics:

0 kommentar(er)

0 kommentar(er)